There are two very important aspects of a successful business. One is revenue and two is keeping track of costs. Many business owners work diligently on the first and neglect the second. In this day and age of computerization, there is no excuse for not keeping track of expenses.

There are many good software programs that are cost-effective, even for the smallest business.

The best overall is QuickBooks Online, the best for Micro-Business Owners is Xero, the best for Service-Based Businesses is FreshBooks; the best for part-time freelancers is QuickBooks Self-Employed and the best free software is Wave.

All these software programs are modestly priced and easy to use with some basic training and practice.

Many

small business owners use personal credit cards to make both

personal purchases and business purchases. This can be a headache at the end of the business year and tax filing time.

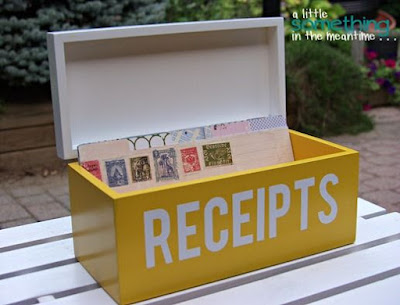

A simple solution to cull business purchases from personal items is to keep a box the size of a shoe box (or a shoe box) in your office and after every purchase, drop the receipt in the box. For every purchase made for business purposes whether the purchase is made by credit card, debit card or cash, make sure you get a receipt.

These receipts bundled, totaled, and stapled together and placed in a file folder at the end of each month provide definitive proof of purchase in the event of an audit or if an item purchased has to be returned for any reason.

At the end of the month, separate them into categories (IE Gas, coffee, meals, parking, gasoline, etc), circle each one on the credit card statement, make a copy of the statement and place that and the receipts in a folder for each month.

I use the following simple form.to add up and total the different categories.

Using this very simple method of bookkeeping and receipt filing saves a great deal of time at year's end.